UNIT 1 (ACMA)

Introduction:

Cost: Cost is the amount incurred for the production and distribution of the product. It does not include income tax, interest on capital, preliminary expenses, dividends, goodwill, bad debts, etc.

Cost Accounting: Recording of cost-related information.

Costing: Costing is the method or technique with the help of which cost can be ascertained.

Definition:

Cost accounting is defined as a system of recording in accounts the materials used and labour employed in the manufacture of a certain commodity/ on a particular job.

Objectives of Cost Accounting: The following are the main objectives of Cost Accounting:-

(a) To ascertain the Costs under different situations using different techniques and systems of costing (b) To determine the selling prices under different circumstances

(c) To determine and control efficiency by setting standards for Materials, Labour, and Overheads

(d) To determine the value of closing inventory for preparing financial statements of the concern

(e) To provide a basis for operating policies which may be a determination of Cost Volume relationship, whether to close or operate at a loss, whether to manufacture or buy from the market, whether to continue the existing method of production or to replace it by a more improved method of production....etc.

(f) To achieve a real and permanent reduction in the unit cost of goods manufactured or services rendered without impairing their suitability for the use intended or diminution in the quality of the product

Scope of Cost Accounting The scope of Cost Accounting is very wide and includes the following:-

(a) Cost Ascertainment: The main objective of Cost Accounting is to find out the Cost of products/services rendered with a reasonable degree of accuracy.

(b) Cost Accounting: It is the process of Accounting for Cost which begins with a recording of expenditures and ends with the preparation of statistical data.

(c) Analysis of Cost: It is the process of locating the factors responsible for the difference in actual cost from the budgeted costs and fixing up responsibility for differences in cost. It provides better cost management and helps in taking strategic decisions.

(d) Cost Control: It is the process of regulating the action so as to keep the element of cost within the set parameters.

(e) Cost Reports: This is the ultimate function of Cost Accounting. These reports are primarily prepared for use by the management at different levels. Cost reports help in planning and control, performance appraisal, and managerial decision-making.

(f) Cost Audit: Cost Audit is the verification of the correctness of Cost Accounts and check on adherence to the Cost Accounting plan. Its purpose is not only to ensure the arithmetic accuracy of cost records but also to see the principles and rules have been applied correctly.

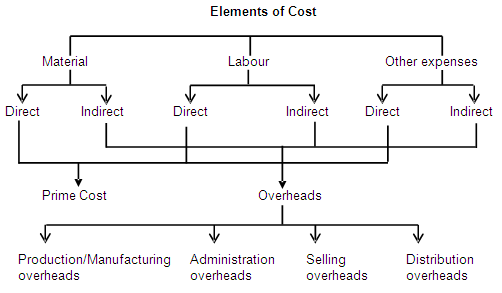

2Q) Elements of cost (5M)

The various elements of cost can be illustrated in the following chart.

Material: The substance from which the product is made is called material. It can be direct as well as indirect.

Direct material: Direct materials are those materials that can be identified in the product and can be conveniently measured and directly charged to the product. Thus, these materials directly enter production and form a part of the finished products.

Examples: Clay in bricks, timber in furniture making, and bricks in building a house.

Indirect material: Indirect materials are those materials that cannot be traced as part of the product. Indirect materials include fuel, and oil required for operating and maintaining plant and machinery.

Examples: nuts and bolts, tools, etc.

Labour: In order to convert materials into finished products, human effort, is required, such an effort is known as labor. Labor can be direct, as well as indirect·

(i) Direct labour: Labour that is directly involved in the production of goods & services and which can be conveniently allocated to a Job, process/commodity unit.

Example: wages paid to the driver, conductor, etc, of a bus in the transport office.

(ii) indirect labour: Indirect labour is labour that is not directly engaged in the production of goods & services but which indirectly helps the direct labour engaged in production.

Example: Mechanics, supervisors, cleaners

(iii) Other Expenses: These may be classified as direct and indirect

(i) Direct Expenses: These are expenses that can be directly, conveniently & wholly identified with a Job, process / productive expenses.

Example: Hire of special machinery required for a particular expense.

(ii) Indirect expenses: These Expenses cannot be directly, conveniently & wholly allocated to cost centers.

Example: Rent, lighting, Insurance charges, etc.

Overheads: Any expenditure over& above prime cost is known as overhead. In general terms, overheads comprise all expenditure incurred for/in connection with the general org. of the whole/ part of the undertaking that is the cost of operating supplies & services used by the undertaking including the maintenance of capital assets.

Overhead may be defined as " The cost of indirect material, indirect Labour & such other expenses including services as cannot conveniently be charged to a specific unit. The major business functions are as follows:

1. Production overhead

2. administration overheads

3. selling overheads

4. distribution overheads

1. Production overheads: These costs are also known as manufacturing overhead, factory overheads/works overheads. They are the aggregate of the indirect expenses of operating the production

division of concern and include all indirect expenses incurred

to convert the raw material into the finished product.

Examples: factory power, cotton waste, consumable stores, depreciation and insurance of plant and machinery and factory building and maintenance, indirect wages, etc

(2) Administration overheads: The other term used is general/ office overheads. These include all such Expenses connected with the direction, control, and administration functions of the business excluding those connected with the selling distribution functions.

Examples: office rent and rates, office lighting & heating, office salaries, audit fees, postage & telephone, printing and stationery, legal charges, depreciation of office building & machinery, etc.

(3) Selling overheads: This type of expenditure is incurred in promoting sales & retaining customers. It is that portion of the marketing cost, is incurred in serving orders.

Example: Advertisement, salesmen salaries, brokerage and commission, bad debts, showroom expenses, traveling expenses:

(4) Distribution overheads: The expenditure incurred from the time Product is completed in the factory until it reaches The market or customer is classified as distribution overheads.

Examples: Packing & shipping expenses, carriage outwards, warehousing costs, delivery van costs, etc.

3Q)Cost sheet (5m)

A cost sheet is a document that provides for the assembly of the estimated detailed cost in respect of a cost center or a cost unit. It is a detailed statement of the elements of cost arranged in a logical order under different heads. It is prepared to show the detailed cost of the output for a certain period. It is only a memorandum statement and does not form part of the double-entry system. Additional columns can be provided to indicate the cost per unit at different stages of production or to enable a comparison to be made of the current costs with that of historical costs.

The main advantages of a cost sheet are:

- it indicates the break-up of the total cost by elements, i.e. material, labour, overheads, etc.

- it discloses the total cost and cost per unit of the units produced

- it facilitates comparison

- it helps the management in fixing selling prices

- it acts as a guide to the management and helps in formulating production policy

- it enables keeping control over the cost of production

- it helps the management in submitting quotations or preparing estimates for tenders

- it is a simple and useful medium of communication of costs to various levels of management.

4Q)COST CONCEPTS:

Comments

Post a Comment